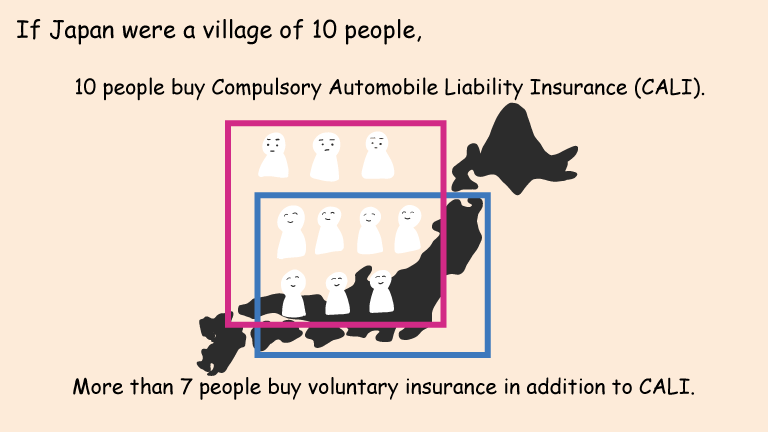

What do you do if you're hit by a car while staying in Japan? If you're injured, you might be worried about how you will deal with medical expenses, lost wages, and the schedule of the rest of your trip. However, you might not need to worry so much. In Japan, it's legally mandatory for every vehicle owner to carry automobile liability insurance. It's called Compulsory Automobile Liability Insurance (CALI.) Additionally, more than 74% of drivers carry voluntary insurance in addition to the CALI. So, if everything goes well, all the expenses might be covered by the at-fault driver's insurance. In this article, we explain the summary of how car insurance covers the traffic accident victim's damages in Japan.

Basic knowledge of automobile insurance in Japan

Carrying automobile liability insurance is legally mandatory in Japan. (The insurance is called CALI.) So, almost all the vehicles on roads carry basic insurance. In addition to the CALI, more than 74% of Japanese drivers purchase voluntary insurance as well. Wealthier people tend to buy additional insurance, but people having less paying capacity tend not to buy additional insurance. In any case, at least you will be compensated with the minimum amount offered by CALI. (In the case where the at-fault driver doesn't carry CALI, there is a relief plan provided by the Japanese government, we will write an article about the plan later.)

Then, in the next chapter, let's look at how your damage will be covered by CALI and voluntary insurance when you are hit by a car driving in Japan.

Case study

CASE 1: You've got whiplash in the traffic accident in which you were not faulty at all. The at-fault driver carries both CALI and voluntary insurance.

Let's think you're hospitalized for seven days, and you have to take 14 days off to focus on medical treatment. You have to commute to hospitals for several months even after you come back to work. In this case, the at-fault driver has an obligation to compensate for all of your damages, for example, the medical expenses, your lost wages, consolation for your pain and suffering, and some miscellaneous expenses.

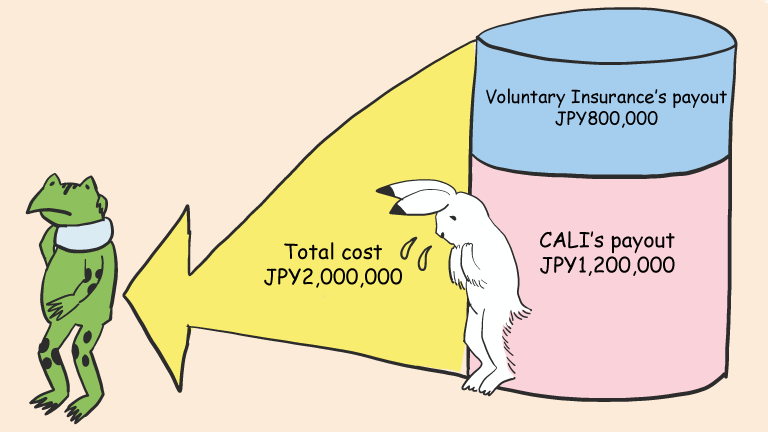

Let's say all the damages cost JPY2,000,000. How does the at-fault driver compensate for the amount? Here's the cost breakdown.

The upper limit of CALI's compensation for an injured victim is JPY1,200,000. So, CALI pays JPY1,200,000. A voluntary insurance company pays the rest of JPY800,000. In most of the cases, a voluntary insurance company applies for CALI's payout on behalf of you, and pay a total of JPY2,000,000 after you end up the treatment.

CASE 2. One of your eyes went blind due to the traffic accident in which you were not faulty. You also got several severe injuries. The at-fault driver carries CALI and voluntary insurance. GIROJ acknowledged your symptom as residual disability.

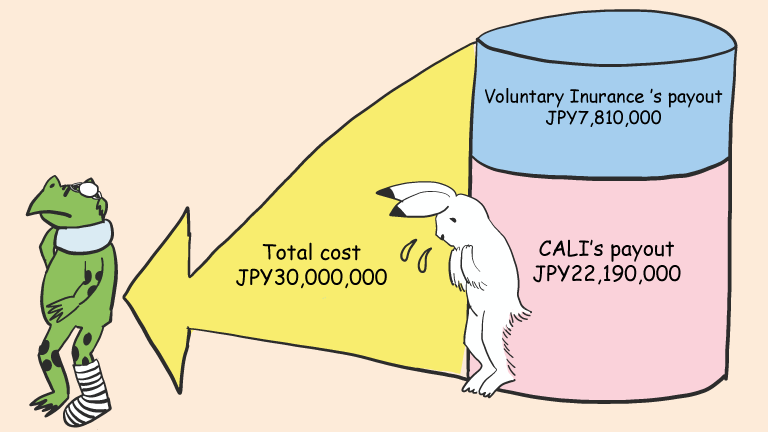

The upper limit of CALI's payout for an injured victim is JPY1,200,000. However, if GIROJ officially acknowledges your symptom as residual disability, it's upper limit increases to JPY40,000,000. However, note that the amount of payout depends on the grade of your disability. In this case, let's think your residual disability is admitted to falling into the third grade of which compensation is JPY22,190,000.

If you got such a big injury resulting in residual disability, all the damages cost a lot. Accordingly, CALI's payout increases, and so does voluntary insurance's payout. In the case where you've got residual disability, the voluntary insurance company applies for CALI's payout on behalf of you. They pay a total of JPY30,000,000 after you end the treatment.

The above both cases are under normal flow. If more practically, it depends on cases. For example, if you are not financially affordable for paying medical expenses and cannot wait for the total payout of voluntary insurance, you can apply for payout to CALI by yourself. See the article on applying for payout from CALI. By doing so, you can receive some amount well in advance of the end of treatment.