CALI has a special payout for people who got a residual disability in a traffic accident. If your auto injury doesn't get well despite the long-time treatment, claim the special payout to CALI. Although CALI is the insurance which owner of the vehicle purchases, car accident victims also have a right to claim CALI's payout by themselves. Although an at-fault party's voluntary insurance company usually claims it on behalf of the victim, we recommend traffic accident victims to claim it by themselves. Here's why we recommend that.

Merit 1: You can get a part of the compensation money in advance of a settlement.

Traffic accident victims have to temporarily pay medical fees and some other costs that might occur due to the traffic accident. They can get compensation money only after a phase of settlement with the at-fault party. However, if GIROJ admits your injury as a residual disability, you can get special compensation of CALI in advance of the final settlement with the at-fault party. (See the tables of CALI's payout for residual disability.) Claiming it by yourself and getting partial compensation money help you to continue the treatment without feeling insecure about your financial status.

Merit 2: The amount of compensation might possibly get higher.

An at-fault party's insurance company usually claims special compensation for a car accident victim's residual disability to CALI. However, the amount of compensation tends to get higher when car accident victims claim it by themselves. Here's why.

At-fault party's insurance company is the one that doesn't want you to get higher grade of residual disability because once you get the higher grade, the amount of compensation you legally deserve gets higher accordingly. If it gets higher, the amount the insurance company has to burden gets higher as well. So it's likely the insurance company doesn't do their best to make the victim get higher grade of residual disability.

Therefore, even if self-application seems troublesome, we recommend all the traffic accident victims to apply for it by themselves.

Merit 3. Show your ability to handle the case to the insurance company

Companies pursue profit. Insurance companies also pursue profit. Voluntary insurance companies always try to reduce the amount of compensation for their profit. They change the amount of compensation depending on who the victim is. If they see you're not familiar with an adequate amount of compensation in Japan, they might suggest a lower amount of compensation.

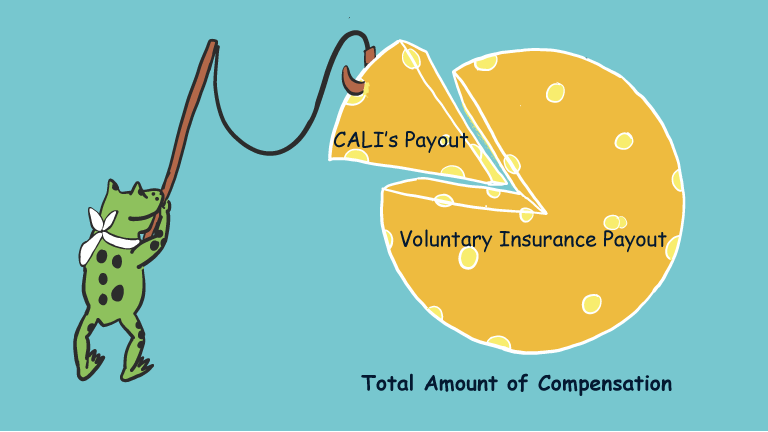

The compensation to car accident victims consists of CALI's payout and voluntary insurance payout. If voluntary insurance companies apply for CALI's payout for residual disability on behalf of you, they might suggest CALI's payout to you as full compensation and might not offer an additional payout by them. Claim the special compensation by yourself so that it won't happen. Show them you can handle it by yourself. By doing so, voluntary insurance company's first suggestion of compensation will start at a more higher amount.

Merit 4: You can save part of handling charge both for a court and attorney

If a traffic accident victim and an at-fault person cannot reach an agreement in a settlement phase, the victim can file a suit and confront the at-fault driver in a court. In this case, the victim has to pay a handling charge to the court and the attorney's fee. The amount of both the handling charge and attorney's fee increases according to the amount of compensation with which you file a suit. So, if you claim the special compensation to CALI and receive it well in advance of the settlement, you can reduce the total amount of compensation with which you file a suit. It means you can reduce the handling charge for both the court and the attorney, as well.